澳洲墨爾本機場退稅說明

Tax Refund, Tourist Refund Scheme, GST Refund

澳洲的消費稅是 10%,若是單次購買超過 $300 澳幣,就可以持著收據去退稅。

退稅是指貨物而已,服務性的消費,如飯店餐飲團費,並不可以退喔!

墨爾本的退稅窗口,設置在一通過海關的右手邊,很容易發現。

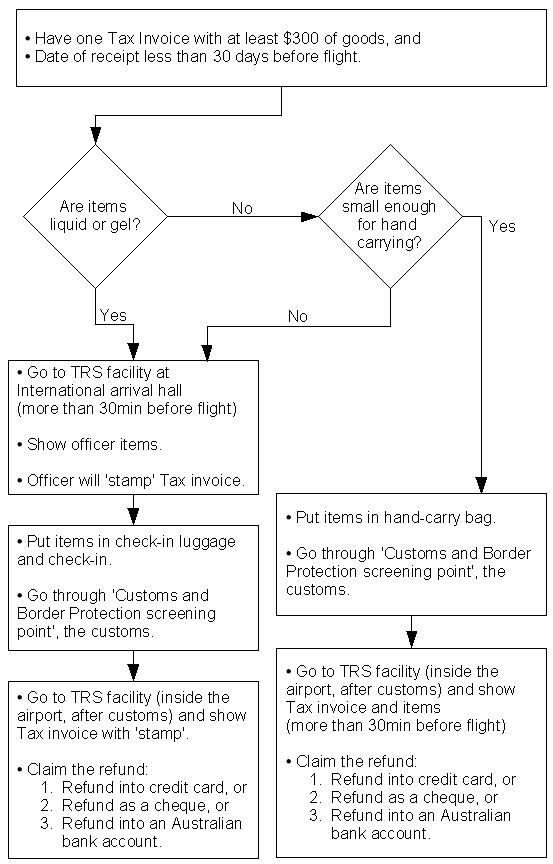

有一點要注意,若您退稅的物品,必須Check-in,請先拿出,給票務的人員在您的收據蓋章,才可以拿進去退稅。

( 證明你有買這樣物品,只是不方便隨身帶上飛機,直接check-in 在大行李了)

以下是導遊 Johnny,針對來墨爾本旅遊,墨爾本機場, 為大家整理的內容。

The Tourist Refund Scheme (TRS) allows tourists to claim back the Goods and Services Tax (GST, currently 10%) on goods (not services) purchased in Australia and taken with them home (overseas).

You need to spend at least A$300 in a single receipt (tax invoice).

Due to the little complexity of the claim process we try to give an overview of what you can do at Melbourne airport should you wish to make a claim.

References with even more details:

English brochure from Australian Customs

(please leave a comment if link is broken)

Australian Customs website on the Tourist Refund Scheme

*Please comment on your experiences with the Tax Refund procedure, it will help fellow guests tremendously.

*Disclaimer: Although we try to be as accurate as possible, we will not be responsible in any way if your tax will not be refunded due to mis-interpretation or wrong information presented on this page.

*Note Change: Date of receipt has than 60 days before flight.

|

|

| Tourist Refund Scheme (TRS) Facility at Melbourne Airport International Arrival Hall.

Sign board says ‘Australian Customs’

|

|

| TRS facility is located within the International arrival hall.

|

|

| Opening Hours: 5am to midnight.

|

|

*Please comment on your experiences with the Tax Refund procedure, it will help fellow guests tremendously.

« P4 可以接送地點 S1, Pickup Location: Subway Springvale Rd x Fern Tree Gully Rd 義大利街的義大利餐館

Universal Italian Restaurant »

歡迎留言

22 Comments so far...

Jacky Says...

您好

如果我的班機是11月14號的凌晨12.50

那我在手機APP申請的時候離開日期可以寫11月13號嗎?

因為在退稅櫃台的時候會是13號的晚上,而那時已經過了出關口,那就已經算出境了?

會有這個疑問是因為我在9月買了iphone 7,雖然是16號取機的(有收據),但在另一張tax invoice 上面的日期是寫9月14號。

1.所以如果申報退稅的日期必須填14號的話那就剛好超過兩個月的時間無法退稅,這樣的話想請問拿著16號的receipt and tax invoice,海關會認定手機是16號買的並讓我退稅 還是他只會看tax invoice的日期?

2.如果申報退稅的日期可以填13號的話,那發票不論是9月14 或 9月16都沒有差別了

希望您能幫助排解我的疑惑

謝謝

Candy Says...

Dear Jacky,

謝謝您的留言詢問。

我是覺得應該可以填 11月13日,畢竟您是 11月13日 辦的退稅。

Best Regards,

Candy

Kenny Chiang Says...

您好 !

我在July 6, 買的被單, 在9月20日出境, 辦理退稅, 他說已超過2個月, 不能退稅.

給了我一張 ” Claim Receipt ” number C8830312.

我不知道不能超過2個月, 這樣還可以退稅嗎 ?

謝謝

Candy Says...

Kenny Chiang 您好,

謝謝您的留言詢問。

真的很可惜,超過 60 天就不可以退稅了。

Best Regards,

Candy

Amy Says...

我買了一部 I-phone 留給老婆在澳洲剩下日子旅遊用,但我先離開澳洲,可否我拿單據離開澳洲時申請退稅先呢?

Candy Says...

Hi Amy,

沒有辦法喔 ! 他們要看到物品 !

Best Regards,

Candy

Laura Says...

我计划买一台Apple Macbook,现在有活动是买电脑送耳机。到时候退税需要携带电脑和耳机以及发票,还是只带电脑和发票就可以?

谢谢并期待您的回复。

Candy Says...

Laura 您好,

謝謝您的留言詢問。

如果發票上看得出耳機,那應該要帶著。

若看不出,就應該不用了。

Best Regards,

Candy

Tam Po Lin Says...

你好!

想請問你我有兩張發票可以申請退稅(Melbourne 飛回香港,這些物品可否全部放在寄倉行李嗎?)當我提早到達Melbourne 機場時,是不是拿所有行李先去TRS counter 蓋印,然後才去航空公司check-in? 當check-in 後,帶著蓋印的發票過海關,然後去TRS 攪tax refund. 這個程序對嗎?另外蓋印的TRS 在哪裏?我在T2 Terminal 離開。

謝謝!

Candy Says...

Hi Tam Po Lin,

根據TRS網站,若要放進託運,應該是在 T2 的 arrival 先辦,

https://www.melbourneairport.com.au/Passengers/Passenger-information/Tourist-Refund-Scheme

Note that there are different conditions for claiming a refund on liquids, aerosols, gels and oversized items. These must first be sighted by the ABF office in T2 arrivals and then checked in with your baggage. Refunds for these goods are then made at the TRS booth using your receipts. More information can be found on the Department of Immigration and Border Protection’s website.

您早點去機場,去問問,會比較保險 !

若您有任何疑問,歡迎您隨時和我聯絡。

謝謝您。

Best Regards,

Candy

Comments: « Previous 1 2 3 Next »

凱蒂墨爾本旅遊資訊

凱蒂墨爾本旅遊資訊